Table of Contents

What is Forex?

Forex (FX) is a blend of Foreign Currency and Exchange.

Foreign exchange is changing one currency into another for various reasons, including commerce, trading, or tourism.

For example, EUR/USD is a currency pair for trading the Euro against the U.S. dollar.

According to Wikipedia, the daily trading volume for forex is $6.6 trillion.

Trading currencies can be risky and complex. Before investing money, you must learn and understand the market’s workings.

A Brief History of Forex

The Forex market has been around for centuries.

People have always exchanged goods and currencies to purchase goods and services.

However, the forex market today is a relatively modern invention.

Initially, currency trading was difficult for individual investors before the Internet. Most currency traders were large multinational corporations, hedge funds, or high-net-worth individuals (HNWIs) because forex trading required much capital.

With the growth of the Internet, a retail market has emerged, helping individual traders to have easy access to the Forex markets through either the banks themselves or brokers making a secondary market.

Most online brokers or dealers offer very high leverage to individual traders who can control an extensive trade with a small account balance.

The Forex Market

The forex market is where you can trade currencies.

Currencies are essential because they allow us to purchase goods and services locally and across borders.

So, we must exchange international currencies for foreign trade and business.

When travelling abroad, it’s common to encounter situations where the local currency is required for transactions instead of the traveller’s currency. This means the traveller must exchange their currency for the local currency at the current exchange rate to make purchases.

For example, an American tourist visiting Kenya cannot use dollars to pay for activities such as seeing elephants, as the local currency used is the Kenyan shilling.

Similarly, when purchasing kiwi fruits from China while residing in the United States, the U.S. importer must pay for the fruits in Chinese Yuan (CNY) and exchange an equivalent value of U.S. dollars (USD) for CNY.

The Forex market is unique because there is no central marketplace for foreign exchange.

Therefore, currency trading is conducted electronically over the counter (OTC), meaning that all transactions occur via computer networks among traders worldwide rather than on one centralized exchange.

Financial Instruments

Traded financial instruments include;

Spot trade.

Forward contract.

Forex swap.

Forex futures

Forex option.

The spot market is the largest of all three markets because it is the “underlying” asset on which forwards and futures markets are based.

When people refer to the forex market, they are thus usually referring to the spot market.

The forwards and futures markets are more popular with companies or financial firms that need to hedge their foreign exchange risks to a specific date.

In addition to forwards and futures, options contracts are traded on certain currency pairs.

Forex options give holders the right, but not the obligation, to enter into a forex trade at a future date and for a pre-set exchange rate before the option expires.

Unlike the spot market, the forwards, futures, and options markets do not trade actual currencies. Instead, they deal in contracts representing claims to a certain currency type, a specific price per unit, and a future date for settlement. This is why they are known as derivatives markets.

Forex vs. Stock: What is The Difference?

Forex Market Hours & Sessions

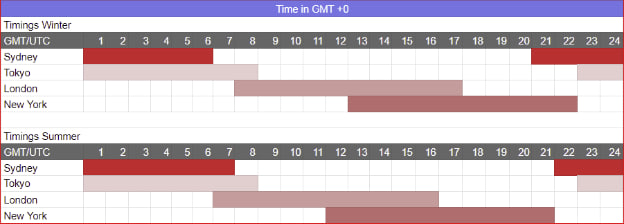

The Forex market is open 24 hours a day, five and a half days a week.

Currencies are traded worldwide in the major financial centres, including;

Frankfurt (Germany)

London (Great Britain)

New York (United States)

Sydney (Australia),

Tokyo (Japan).

Here is where you can view Forex market session hours in your local time zone.

The Best Session to Trade Forex

The best time to trade Forex is when the market is the most active. The market has the most significant trading volume during this time.

During active hours, it is easy to spot many trading opportunities and yield better profits, as we will see in our intermediate and advanced courses.

Therefore, the most active hours are when sessions overlap.

So, the best sessions to trade Forex include;

New York and London: Between 8:00 am — 12:00 noon EST (EDT)

Sydney and Tokyo: Between 7:00 pm — 2:00 am EST (EDT)

London and Tokyo: Between 3:00 am — 4:00 am EST (EDT)

The Forex Market Participants

The forex market comprises a variety of participants, from large banks and other financial institutions to individual traders.

Banks and other financial institutions are the largest participants in the forex market, accounting for around 70-80% of the total market volume. These institutions are typically responsible for large transactions in the market, such as trading for their clients or their accounts. They also provide liquidity to the market by providing quotes for buying and selling currencies.

Other participants in the forex market include hedge funds, currency traders, and retail forex brokers.

Hedge funds are large investors who make large bets on currency movements. In contrast, currency traders are typically individuals or small firms who trade in the forex market for their accounts.

Retail forex brokers provide online trading platforms and services to individual traders, allowing them to access the forex market.

Finally, central banks also have an essential role in the forex market, as they can influence the value of currencies through their monetary policies.

In our intermediate and advanced courses, we will learn how we can trace the footsteps of these forex market participants and spot high-probability trading opportunities in an intelligent money way.

Forex Currency Pairs

A currency pair is the quotation of two different currencies, with the value of one currency being quoted against the other.

Because one currency is bought and one sold, exchange rates are always quoted in pairs.

When trading Forex markets, we’re always concerned with currency pairs, not just a single currency.

Example:

EUR/USD pair – the Euro and the US Dollar.

The first currency in the pair is called the base currency, and it is always worth 1.

In contrast, the second currency is called the quote currency. It shows how much of the quote currency you will exchange for 1 unit of the base currency.

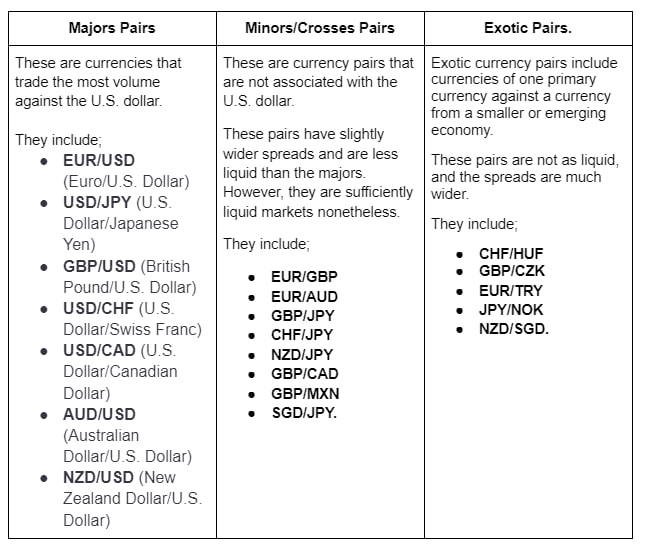

Majors, Minors & Exotic Currency Pairs

Theoretically, you should be able to trade any currency in the world with any other.

However, you only have access to those offered by your Forex broker.

Volatile Currency Pairs

Volatile currency pairs are currency pairs that experience large and sudden price swings in a short time.

The higher the level of currency volatility, the higher the risk, and vice versa.

Some of the most volatile forex pairs are;

AUD/JPY (Australian Dollar/Japanese Yen)

NZD/JPY (New Zealand Dollar/Japanese Yen)

AUD/USD (Australian Dollar/US Dollar)

CAD/JPY (Canadian Dollar/Japanese Yen)

AUD/GBP (Australian Dollar/Pound Sterling)

Major currency pairs tend to have lower volatility compared with the exotic pairs, as when there is high liquidity, there tends to be lower volatility.

Currency pairs from more developed countries tend to have lower volatility as prices are typically more stable.

There is also a lower supply and demand for currencies from emerging markets.

What Causes Volatility in Forex?

Various economic, political, and psychological factors can cause volatility in the Forex market.

On the economic side, major economic news and data releases, such as central bank decisions on interest rates, unemployment figures, or GDP reports, can cause currency prices to fluctuate rapidly.

Political events, such as elections, international trade negotiations, or geopolitical tensions, can cause market volatility.

On the psychological side, factors such as investor sentiment, market psychology, or herd mentality can all contribute to volatility.

Finally, technical aspects, such as algorithmic trading, high-frequency trading, or market liquidity, can cause Forex prices to move quickly.

Most Traded Currencies in the World

The table below shows the most traded currencies by value as of April 2019.

Rank | Currency | Code | Symbol | % Volume |

1 | USD | US$ | 88.3% | |

2 | EUR | € | 32.3% | |

3 | JPY | 円 / ¥ | 16.8% | |

4 | GBP | £ | 12.8% | |

5 | AUD | A$ | 6.8% | |

6 | CAD | C$ | 5.0% | |

7 | CHF | CHF | 5.0% | |

8 | CNY | 元 / ¥ | 4.3% | |

9 | HKD | HK$ | 3.5% | |

10 | NZD | NZ$ | 2.1% |

On the other hand, the most heavily traded bilateral currency pairs include;

EURUSD (Fiber)

USDJPY (Ninja)

GBPUSD (Cable)

What Moves the Forex Market?

Various factors, including economic news, central bank policies, geopolitical events, and market sentiment, move the forex market.

The forex market’s primary driver is different currencies’ supply and demand. When demand for a particular currency increases, its value will go up relative to other currencies. Conversely, its value will decrease when demand for a particular currency decreases.

Central banks, governments, and other international organizations can influence the forex market by buying and selling currencies.

Finally, geopolitical events and market sentiment can also affect the direction of the forex market.

Forex Terminology

The best way to start the forex journey is to learn its language.

Here are a few terms to get you started;

Forex account: A forex account is used to make currency trades. Depending on the lot size, there can be three types of forex accounts:

- Micro forex accounts allow you to trade up to $1,000 worth of currencies in one lot.

- Mini forex accounts: Accounts that will enable you to trade up to $10,000 price of currencies in one lot.

- Standard forex accounts: Accounts allowing you to trade up to $100,000 worth of currencies in one lot.

Remember that the trading limit for each lot includes margin money used for leverage. The broker can provide you with capital in a predetermined ratio.

If you are a beginner, setting up a micro forex trading account with low capital requirements is a good idea.

Ask: (or offer) is the lowest price you are willing to buy a currency.

For example, if you place an asking price of $1.3681 for GBP, the figure mentioned is the lowest you are willing to pay for a pound in USD.

The asking price is generally more significant than the bid price.

Bid: A bid is a price you are willing to sell a currency.

A market maker in a given currency is responsible for continuously putting out bids in response to buyer queries. While they are generally lower than asking prices, bid prices can be higher than asking prices when demand is excellent.

Spread: A spread is a difference between a currency’s bid (sell) price and the ask (buy) price.

Forex traders do not charge commissions; they make money through spreads.

Many factors, such as the size of your trade, currency demand, and volatility, influence the size of the spread.

Bear market: A Bear market is when prices decrease in the market.

It signifies a market downturn resulting from depressing economic fundamentals or catastrophic events, such as a financial crisis or a natural disaster.

Bull market: A Bull market is when prices increase in the market.

It signifies a market uptrend and results from optimistic news about the global economy.

Leverage: Leverage involves borrowing a certain amount of the money you invest in something; in this case, money is usually borrowed from a broker.

Example:

You might put up just $100 of your capital and borrow $900 from your broker to trade against the EUR in a trade against the USD.

Since you have used very little of your capital, you can make significant profits if the trade goes in your anticipated direction.

Similarly, your losses will multiply if the trade goes in the opposite direct currency.

Lot size: This is a standard unit of resurrection amounts. A lot is composed of 100,000 units of a currency, and it is the smallest available trade size that you can place when trading the markets.

When someone trades a certain number of lots, it is referred to as a “position size.”

The four common lot sizes include

- Standard Lot: A standard lot is the equivalent of 100,000 units of the base currency in a forex trade. A standard lot is similar to trade size. It is one of the three commonly known lot sizes: mini-lot and micro-lot.

- Mini Lot: A mini lot equals 10,000 units of the base currency in a forex trade. A mini lot is one-tenth of a standard lot or 100,000 units.

- Micro Lot: A micro lot equals 1,000 units of the base currency in a forex trade. A micro lot is usually the smallest position size you can trade with. It is one-tenth of the size of a mini lot.

- Nano Lot: A nano lot equals 100 units of the base currency in a forex trade. A nano lot is the smallest position size that you can trade with. It is one-hundredth of the length of a micro lot.

Note:

High leverages characterize the forex market, and traders often use them to boost their positions.

Therefore, choosing a lot size significantly affects the overall trade’s profits or losses. The bigger the lot size, the higher the profits (or losses), and vice versa.

Margin: Margin is essentially the money you need to put forward to place a trade and maintain a position.

Margin money helps assure the broker that you will remain solvent and be able to meet monetary obligations during your open position, even if the trade does not go your way.

The amount of margin depends on the trader and customer balance over a while. Margin and leverage (defined above) are used for trades in forex markets.

Pip: A pip is a “percentage in point” or “price interest point.” It is the minimum price move made in currency markets, equal to four decimal points.

Example:

For most currency pairs, one pip equals 0.0001, but for pairs involving the Japanese yen, one pip equals 0.01.

A pip measures gains or losses in currency pairs in forex trading. For example, if the EUR/USD moves from 1.1700 to 1.1750, it has increased by 50 pips.

Stop orders: Stop orders are where you instruct your broker to place a buy trade at a price higher than the current price or a sell trade lower than the current price.

Stop-loss orders are closing orders at a price level representing a certain amount of loss if the market moves against you.

Limit orders: You ask your broker to place a buy trade lower than the current price or a sell trade higher than the current price.

Contract for difference: A contract for difference (CFD) is a derivative that lets traders speculate on price movements for currencies without owning the underlying asset.

If you anticipate that the price of a currency pair will increase, you will buy CFDs for that pair, and vice versa.

Sniping and hunting: Sniping and hunting are two popular Forex trading strategies.

Sniping involves tracking and entering trades on short-term trends, often taking advantage of small price movements that may be difficult for other traders to detect.

On the other hand, hunting is a more aggressive strategy that involves taking a larger position and holding onto it for a longer time to capitalize on larger price movements.

Both strategies have the potential to be profitable, but they require a careful trader to be successful.

Brokers indulge in this practice, and the only way to catch them is to network with fellow traders and observe such activity patterns.

How to Start Trading Forex

Trading forex is similar to equity trading. Here are some steps to get yourself started on the forex trading journey.

Learn about forex: While it is not complicated, forex trading requires specialized knowledge.

Develop a trading strategy: While it is not always possible to predict and time market movement, having a trading strategy will help you set broad guidelines and a road map for trading. A good trading strategy is based on good market psychology and solid risk management.

Define the type of trader you are.

Set up a brokerage account: You will need a forex trading account at a brokerage to get started with forex trading. Most retail forex brokers do not charge commissions on trades. Instead, they make money from the spreads, the difference between the bid and ask prices of a currency pair. However, some brokers charge commissions, depending on the type of account you open.

Types of Forex Traders

An essential thing in forex is to define the type of trader you are. The primary forms of forex trade are long trade and short trade.

Traders can also use trading strategies based on fundamental analysis, technical analysis such as breakout and moving average, and Smart Money Strategy that we will learn in intermediate and advanced courses to help you fine-tune your approach to trading.

Depending on the duration and numbers for trading, trading strategies can be categorized into four different types;

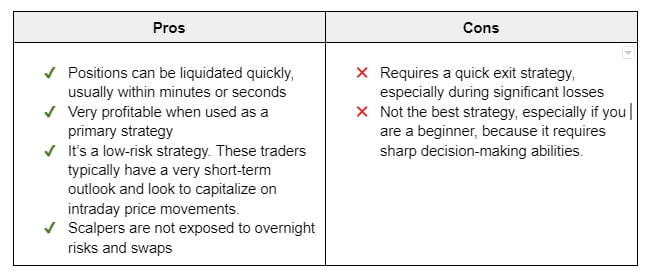

1. Scalper

Scalpers are traders looking for opportunities from small price movements. They typically hold their trades for only a few minutes or even seconds.

2. Day trader

Here, a trader is involved in short-term trades in which positions are held and liquidated on the same day. The duration of a day trade can be hours or minutes.

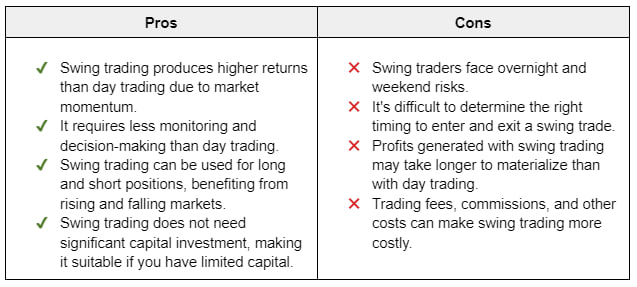

3. Swing Trader

Swing traders are a type of trader who holds their trades for longer than a day, sometimes even for days or weeks. They aim to profit from the price swings or fluctuations that occur in the market over this period of time.

This type of trading strategy can be beneficial if you don’t want to monitor your trades daily and looking for a more relaxed approach to trading.

However, waiting for the right opportunity to enter and exit a trade requires patience and discipline.

4. Position Trader

Position traders hold positions for an extended period, ranging from weeks to years.

Unlike swing trading, position trading requires a strong grasp of fundamental analysis to make informed trading decisions.

Position traders aim to capitalize on long-term trends and market movements, making understanding market fundamentals and industry trends important.

While position trading requires patience, it can result in significant profits if executed correctly.

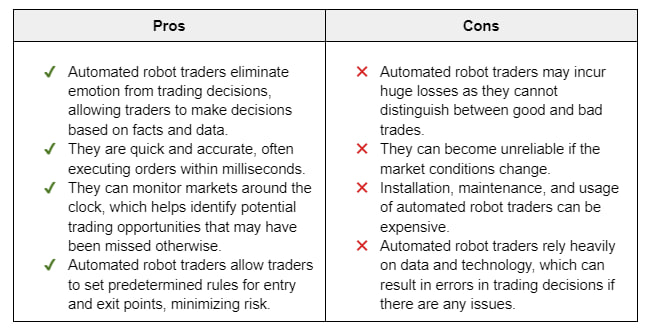

5. Automated Robots Trader,

Automated robot traders are computer programs that automatically buy and sell various financial instruments on the markets.

These systems analyze market data, technical indicators, and historical trends to make decisions.

They are designed to constantly monitor the markets and execute orders automatically without requiring manual intervention.

Professional traders commonly use this type of trading to enhance their profits.

The above types of traders are grouped into two main categories;

Retail Trader: These are individual traders who trade for their accounts. For example, if you plan to trade using your computer or phone.

Institutional Traders: They are also called the Big Boys/Sharks/Big Fish/Smart Money Traders. They make trades for Banks, Institutional Companies, and Hedge Funds. They have enough money to move the market.

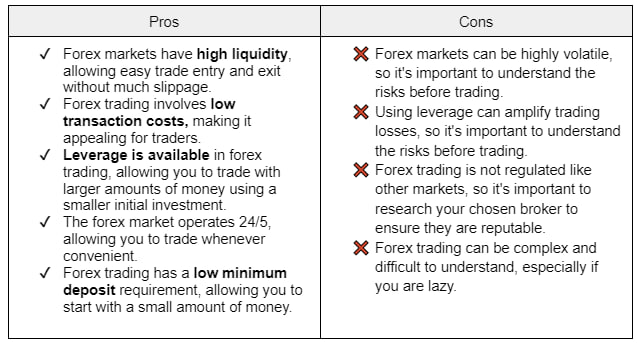

Pros & Cons of Trading Forex