Let’s dive into the thrilling world of forex trading—a dance of currencies, economic symphonies, and calculated risks.

From novice steps to seasoned twirls, this journey promises both heart-pounding beats and quiet reflections.

Welcome to the stage where mastery whispers your name! 🌟📈🕺💰

1. Introduction to Forex Trading

Forex trading, also known as foreign exchange trading, involves buying and selling currencies to profit from exchange rate fluctuations.

It’s like a global marketplace where currencies dance to economic tunes, geopolitical events, and investor sentiment.

As a beginner, you step onto this dynamic stage with wide-eyed curiosity.

2. Understanding the Forex Market

Picture a bustling bazaar where currency pairs—XAUUSD, EUR/USD, GBP/JPY, and more—engage in a lively tango.

Each pair has its unique rhythm, influenced by economies, central banks, and news.

Your job..?

…predict their moves.

Dive into charts, candlesticks, and economic indicators. Learn the lingo: pips, lots, and leverage.

Understand that losses are part of the dance.

3. Setting Up Your Trading Account

Choose a reputable forex broker—your backstage pass to the market.

Research, compare spreads, and ensure they’re regulated.

Create your account, deposit funds, and embrace the thrill. Remember, discipline is your wingman.

No impulsive moves; just calculated steps.

4. Developing a Trading Plan

Imagine a choreographed routine. Your trading plan defines it!

Set goals—daily, weekly, monthly.

Define risk tolerance (don’t bet the house!). Decide on entry and exit strategies. Stick to your script even when the market throws a curveball.

5. Learning Market Analysis

Meet your mentors: Fundamental Analysis and Technical Analysis.

Fundamentals peek into economic reports, interest rates, and political drama.

Technicals decipher patterns, support, and resistance, supply and demand and more.

Blend both—like a DJ mixing beats—to make informed decisions.

6. Practicing with a Demo Account

Before the spotlight, rehearse backstage.

Demo accounts are your dress rehearsals. Execute trades, test strategies, and learn without real money. Fail gloriously; it’s part of the act. Adjust your routine based on what works and what flops.

However, DO NOT OVERSTAY on DEMO!

7. Developing Risk Management Skills

Risk management is your safety net. Set stop-loss orders—like safety harnesses—so you don’t plummet off cliffs. Risk only a fraction of your capital per trade.

Remember, even the best dancers stumble; it’s how they recover that matters.

8. Building a Trading Routine

Consistency is your encore. Wake up, analyze, trade, review. Rinse and repeat.

Journal your performances—wins, losses, emotional wobbles. Fine-tune your routine. Maybe add meditation or salsa dancing (seriously, it helps).

9. The Journey Unfolds

You’ll face drawdowns, euphoria, and plateaus.

Celebrate small wins; learn from losses.

Seek mentors, read books (like “Trading in the Zone” and “Think and Trade Like a Champion”).

Join forums, attend webinars. Copy successful traders (but don’t plagiarize!).

You want to join my 100% FREE Signals & Mentorship?

Online WEEKLY Classes

10. Mastery Beckons

Years pass. You’ve waltzed through storms, moonlit nights, and sunrise rallies.

Your trading journal thickens. You’ve internalized patterns, embraced patience, and tamed emotions.

Mastery isn’t about perfection; it’s about resilience. You’re no longer a beginner; you’re a seasoned performer.

And there you have it—the forex trader’s odyssey. From stumbling steps to graceful twirls, the journey molds you.

So, dear trader, keep your eyes on the charts, your heart in check, and your dreams soaring. The stage awaits, and mastery whispers your name.

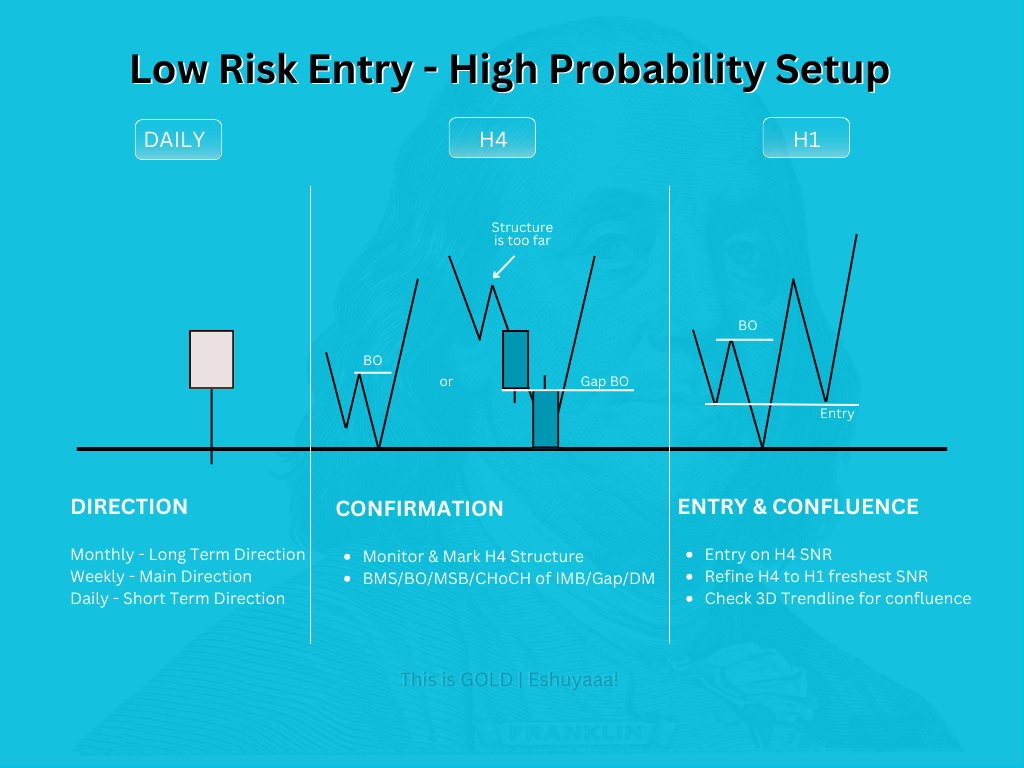

How to Spot Low Risk Entry When Doing Top-Down Analysis

Spotting low-risk entry points during top-down analysis involves a systematic approach to analyzing …

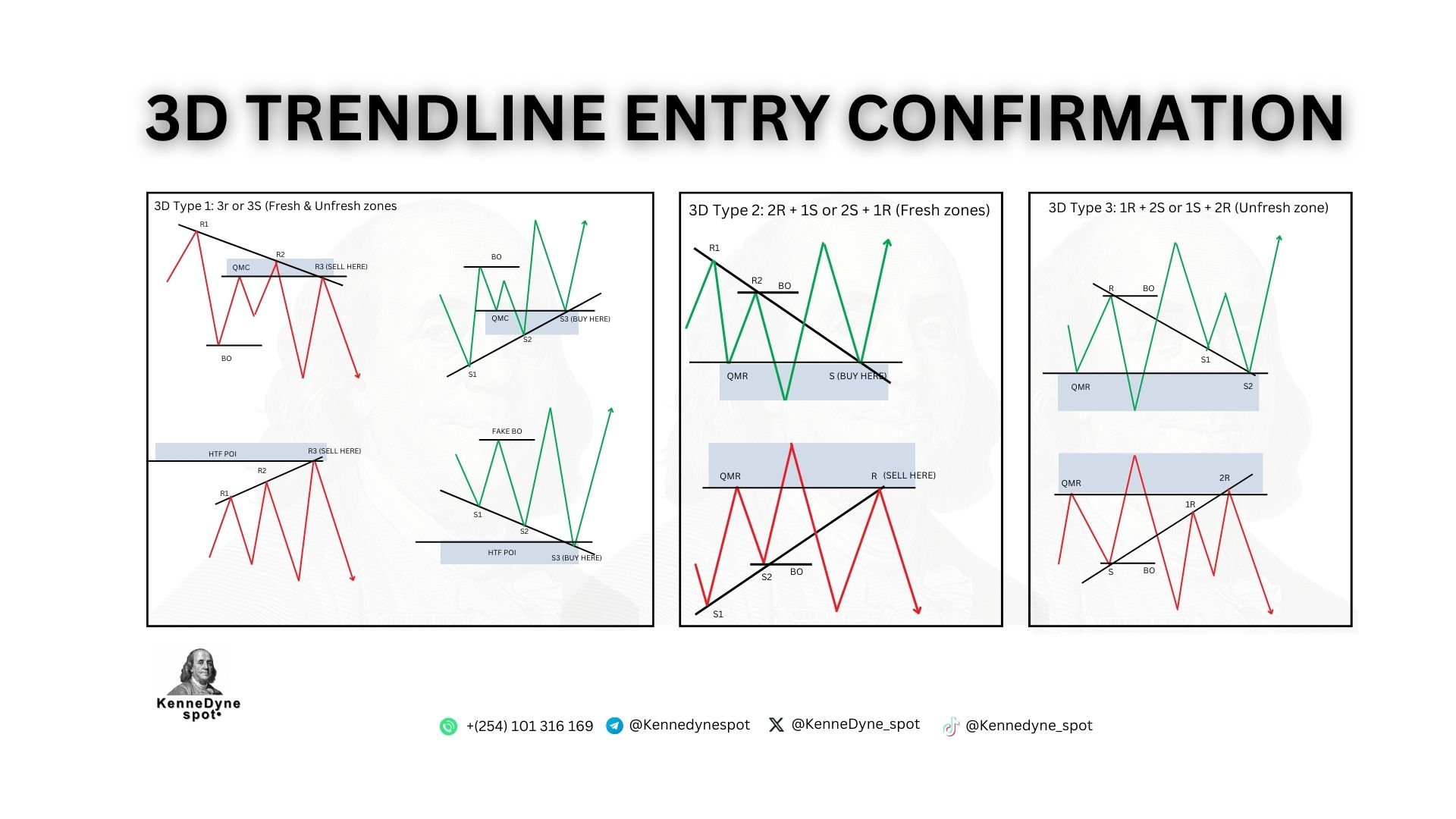

Trade Entry Magic: How to Confirm Winning Setups using 3D Trendline

Mastering trade entry confirmation is essential for successful forex trading. A trade entry co…

The Forex Trading Roadmap: From Beginner to Mastery

Picture a bustling bazaar where currency pairs—EUR/USD, GBP/JPY, and more—engage in a lively tango. …

Demo Trading vs Live Trading: Which Is Best for You?

Demo and live trading are two options to practice trading and build your trading skills. However, c…

How the Smart Money Trades: An Inside Look at Institutional Trading

"Smart money" is a term that's used to describe the actions of institutional traders. These are the …

The Psychology of Forex Trading: How to Win Over the Market

To be successful in Forex Trading, you need to understand how the market works and anticipate the bi…

Disclaimer: This blog is for educational purposes only. Trading involves risk, and past performance doesn’t guarantee future success. Consult a financial advisor before pirouetting into the forex arena.

Recent Comments