When it comes to trading, there are lots of opportunities, you as a trader can leverage to have multiple income streams.

Besides currencies, crypto, and metals, you can also trade Synthetic Indices which have been in the market for over 20 years with a proven track record.

In this comprehensive guide, I will explain what these synthetic indices are and why you need to trade them.

What are Synthetic Indices?

Trading that is not affected by the time of the day or global events is what synthetic indices have to offer.

Synthetic indices, therefore, are trading instruments that are designed to simulate the behavior of real-world financial markets.

This means that synthetic indices behave like real-world markets but their movement is not a result of any underlying financial asset.

For instance, the forex and stock markets move with respect to the price movement of the currency pair and stock, respectively, but with synthetic indices, things are different.

The key feature of these synthetic indices is that they are not affected by fundamentals like world events or news.

Synthetic indices are available to trade 24/7, have constant volatility and fixed generation intervals, and are free of the market and liquidity risks.

What Moves Synthetic Indices?

Since synthetic indices simulate the real monetary market, their behavior is created by the use of randomly generated numbers.

These numbers are created by a cryptographically secure computer program (algorithm).

The algorithm generates the value for the synthetic indices (quote) guided by the type of market assigned to simulate.

Does Deriv/Binary.com Manipulate Synthetic or Volatility Indices?

No, Deriv does not manipulate synthetic indices.

As stated earlier, synthetic indices move through random numbers generated by an algorithm. Therefore, for transparency issues, Deriv is unable to influence or predict which numbers will be generated.

Just like in real-world financial markets, brokers have no influence on the movement of prices.

The random number generator is also regularly audited by an independent third party to ensure fairness.

This ensures that Deriv is not manipulating the price of volatility and synthetic indices.

Is Deriv regulated?

In the EU, Deriv is regulated by the Malta Financial Services Authority (FSA).

For traders outside of the EU, the broker is licensed with the Vanuatu Financial Services Commission (FSC) and the British Virgin Islands Financial Services Commission (FSA).

Deriv is also regulated by Malaysia’s Labuan Financial Services Authority (FSA).

Therefore, I believe that all these regulatory authorities would not let Deriv or Binary.com manipulate synthetic & volatility indices to their advantage.

Do we have Deriv alternative brokers?

No, Deriv is the only broker that offers synthetic indices trading in the world because it created and owns the algorithm that runs these indices.

I don’t think there is any other broker that can offer synthetic indices because they do not have access to the random number generator and if they did, it would be illegal.

Compared to forex and stock, there are lots of brokers who use financial trading instruments because no one ‘owns’ these markets.

Therefore, any broker that can get real-time quotes of the forex and stock markets can easily provide them for trading to their clients.

How Do You Trade Synthetic Indices On MT5?

You need a dedicated account inside your main Deriv account to be able to trade synthetic indices on MT5.

This is because Deriv offers a variety of different trading instruments including forex currencies, cryptocurrencies, stocks, commodities, and, of course, synthetic indices.

You will need different accounts within your main Deriv account to trade these different instruments.

In this section, am going to give you a comprehensive guide on how you can open a synthetic indices account and then trade synthetic indices on MT5

A Step By Step: How to Open A Synthetic/Volatility Indices account on MT5

If you already have a Deriv/Binary.com account, you can skip this section.

How To Open Synthetic Indices

Trading Account On Deriv.com Step By Step

1. Open A Deriv.com account

First, you need to open an account by clicking the link below.

This is the same account used for trading binaries and the same platform as Binary.com

You will see a box like this:

-

- Click on ‘Create Demo Account’ and enter your email.

-

- Confirm your email by opening it and clicking the link sent by Deriv.

-

- If you don’t find the email check your Junk/Spam folder.

Complete the signing up by entering your preferred password and country of residence.

READ: READ TRADABLE VS NON-TRADABLE ORDER BLOCKS

2. Open A Real Trading Account

By default, you will first create a demo account with virtual funds of $10,000 when you sign up.

This demo account is meant to help you get used to the platform and try out strategies etc.

However, to trade real money you will have to open a ‘Real’ account.

To open the real account you will need to log in to the Deriv wallet you created in the step above.

After logging in you will see the screen below.

Begin by clicking on the dropdown menu beside the $10 000 virtual money balance.

The first option under the Real tab will be the option to add a real Deriv account.

Click on the add button.

The following screen will appear:

You will need to choose your preferred account currency. This is the currency that you will use to trade, deposit, and withdraw.

You can also create another account with another currency of your choice by clicking on the ‘Add or manage account’ tab.

On the next few pages add your correct details including name, address and phone number. You will need to use details that you can later verify.

This is because as part of its Know Your Customer (KYC) policy, Deriv will ask you to upload your proof of residence and ID or passport.

These documents must have the same details you will provide during the registration.

READ: SMART MONEY ENTRY TYPES

3. Open A DMT5 Synthetic/Volatility Indices Trading Account

Note that, you can use the real account you have just created to trade binary options on Deriv.com but you cannot use it to trade on DMT5.

To trade synthetic and volatility indices on MT5 you will need to open a dedicated MT5 synthetic indices account.

Also, note that you are able to create up to three DMT5 accounts (for different Deriv instruments) from the real account you have just created above.

So, for an MT5 synthetic indices account, click the ‘Add‘ button next to that account type.

The first step will ask you to choose a password for the DMT5 synthetic indices account. This is the password that you will use to log in to your Metatrader 5 account.

After creating the account you will now see the account listed with your login ID. You will also get an email with your login ID that you will use to log in to the MT5 synthetic indices account.

Can you see the DMT5 account listed with account ID 1249232?

After creating your account you will be prompted to transfer funds from your main account to your DMT5.

READ: UNDERSTANDING LIQUIDITY

4. Download the MT 5 platform

You will then need to download the MT5 platform.

Click on the synthetic account as shown below.

You will then be taken to a page with links to the Metatrader 5 application for various systems like Android, Windows, iOS, etc at the bottom of the page.

Download the one you want to use.

5. log in to your MT 5 account

After downloading and installing your DMT5 you will then need to log in to your trading account.

Click on setting > Log in to a new account. (if you’re using a phone device, click on the ‘+’ sign on your MT5 platform)

You will need to enter the following details:

Broker: Deriv Limited

Server: Deriv-Server

Login: Your account ID

Password

Types of Synthetic Indices Available on Deriv Platform

| Synthetic Indices Type | Definition | Example |

| Volatility indices | These indices correspond to simulated markets with constant volatilities of 10%, 25%, 50%, 75%, and 100%. One tick is generated every two seconds for volatility indices 10, 25, 50, 75, and 100. One tick is generated every second for volatility indices 10 (1s), 25 (1s), 50 (1s), 75 (1s), and 100 (1s). | Volatility 10 (1s) Index Volatility 25 (1s) Index Volatility 50 (1s) Index Volatility 75 (1s) Index Volatility 100 (1s) Index Volatility 10 Index Volatility 25 Index Volatility 50 Index Volatility 75 Index Volatility 100 Index |

| Crash & Boom | With these indices, there is an average of one drop (crash) or one spike (boom) in prices that occur in a series of 1000 or 500 ticks. | Boom 1000 Index Boom 500 Index Crash 1000 Index Crash 500 Index |

| Jump indices | These indices correspond to simulated markets with constant volatilities of 10%, 25%, 50%, 75%, and 100%. There is an equal probability of an up or down jump every 20 minutes, on average. The jump size is around 30 times the normal price movement, on average. | Jump 10 Index Jump 25 Index Jump 50 Index Jump 75 Index Jump 100 Index |

| Step indices | With these indices, there is an equal probability of up/down movement in a price series with a fixed step size of 0.1. | Step Index |

| Range break indices | These indices fluctuate between two price points (borders), occasionally breaking through the borders to create a new range on average once every 100 or 200 times that they hit the borders. | Range Break 100 Index Range Break 200 Index |

A Winning Trading Strategy for Synthetic Indices

Any strategy can work on synthetic indices, whether Price Action or Smart Money Concept. Therefore, it’s important to practice the knowledge you have acquired online and blend it into what works for you.

In this section, I will show you an example of how I spot my setups and confirmations.

Rule[s]

-

- Always trade with trends (follow the trend as it’s easy-to-spot setups).

-

- Do multi-timeframe analysis to find your setups and confirmation.

Order Block Trading Strategy

Order Block, otherwise abbreviated as OB, is a zone identified by a candle, where it is believed that banks and large institutions have accumulated their orders.

So, OB can be a down candle before the move up or an up candle before the move down.

When trading OBs, it’s important to consider the location of the OB you want to trade. Not all OBs are tradable.

Some of the common factors you can consider for high probability OB include;

-

- Trend (Order Flow)

-

- Imbalance

-

- Support & Resistance

-

- Flip Zone

-

- Supply & Demand

-

- Significant Support & Resistance Level etc

-

- Market Structure Break

-

- Manipulation

-

- Liquidity Raid (Stops Hunt)

Examples

I will not explain these factors in detail because we already have countless content on the same; I will share a few examples of how you can combine 2-3 factors for high probability setups.

You MUST ALWAYS REMEMBER to perform multi-timeframe analysis to know the market’s overall trend and spot the setups that align with your rules.

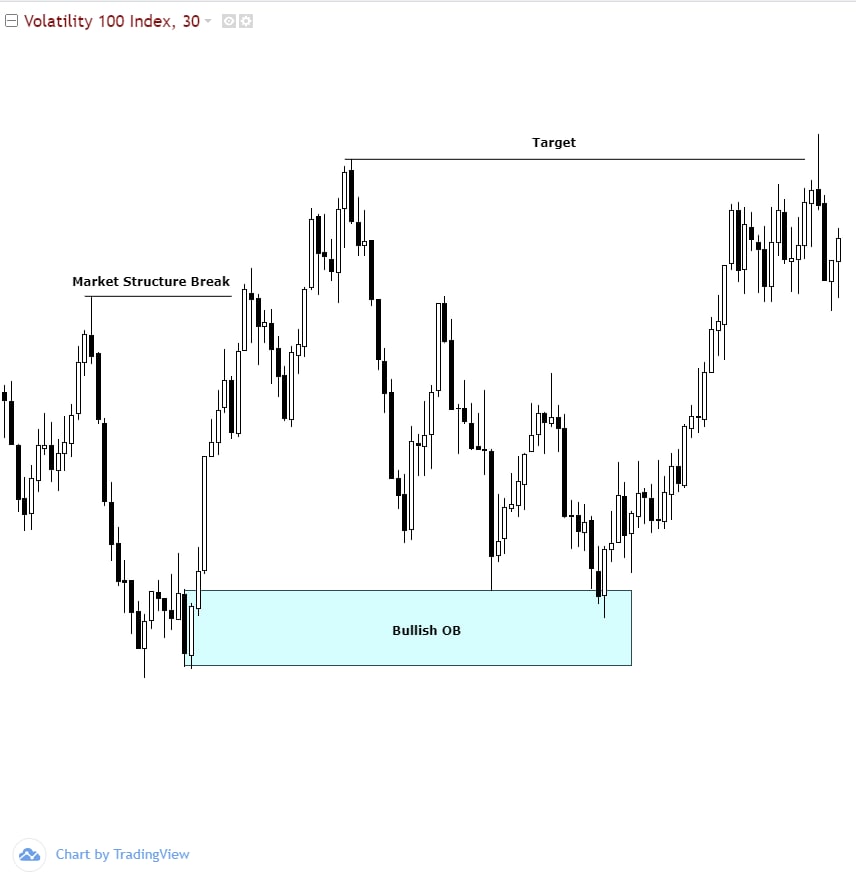

1. Market Structure Break (BMS/BOS) + Stop Hunt

This setup is ideal when the market changes direction (Bullish-Bearish or vice versa) = high risk or when the market is done with retracement (low risk).

You might often not see this setup after the market is done with its retracement due to reacting to a high liquidity zone. Always check for fake outs/manipulations (EQH/L) on your respective TF.

2. Significant Support/Resistance (Sig S/R & SSR) + Clear Breakout

OB on significant S/R is also highly probable. Just be sure you are in line with the trend direction.

Sig S/R is also an excellent location for spotting hidden OBs.

3. Flip Zone (FZ) + BMS

Here, you can trade Flip Zones directly (High risk) or the manipulation of FZ (low risk).

ONLY trade FZ directly if there is a valid Breaker (Failed valid OB).

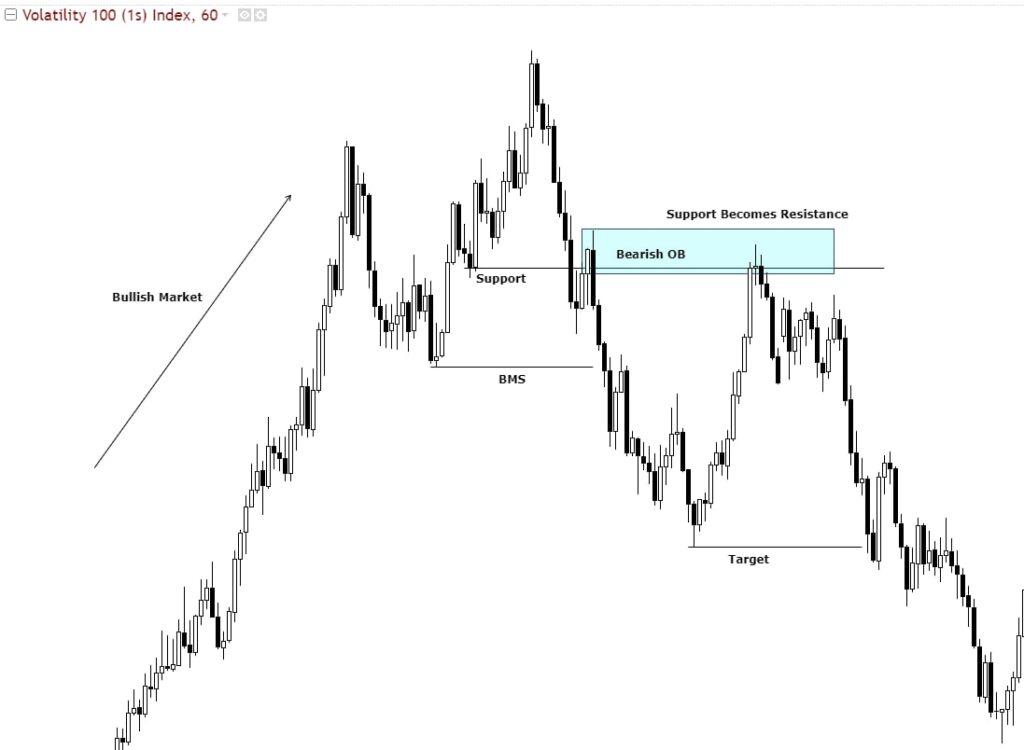

4. Support Becomes Resistance and vice versa

When trading FZ, you want your S to become R or R to become S.

We need to be keen on the price action when S/R is being broken; that’s where we will look for OB.

5. Breaker (Failed OB)

Breaker is also another technique for anticipating a valid FZ.

A high probability Breaker is often identified using a clean breakout. But if there is not a clean break.

Synthetic Indices vs Forex: What’s the Difference?

1. Underlying Asset/Cause Of Movement: Forex markets move depending on the relative strength of the real currencies of different countries. Synthetic Indices are simulated markets that move through random numbers generated by a computer also.

2. Volatility: Volatility (the rate of price change) in the forex market varies at different times due to a number of factors such as news, sessions, etc. This makes forex tricky to trade at some times so you have to find the best time to trade. On the other hand, Synthetic Indices have consistent volatility all year round. Therefore, there is no better time for trading synthetic indices. Your work as a trader is to find and identify high-probability setups.

3. Availability/Trading Times: Forex currency markets are open from Monday to Friday when the world’s financial centers are open. The markets are closed on weekends and during holidays. Synthetic Indices are available 24/7, 365/6 days. You can trade them anytime, any day.

4. Brokers Offering Trading Instruments: There are a lot of brokers that offer forex trading services in the world. As a trader, you must choose a broker that fits your circumstances. Our recommended broker is Exness. (Strictly regulated, tight spreads, instant deposit, and withdrawal on all payment methods). On the other hand, only one broker is offering Synthetic/Volatility Indices. That broker is Deriv (formerly known as Binary.com) and offers Forex and Synthetic Indices trading. So by using the broker, you get to shoot two birds with one stone.

5. Trading Platforms: You can trade forex on MT4 and MT5 depending on the broker you are using. Synthetic indices, on the other hand, you can only trade on MT5 synthetic indices account from Deriv.

Why Trade Synthetic Indices?

Before you decide on strategies to trade synthetic indices, you first need to understand why you would trade synthetic indices at all.

There are multiple benefits of synthetic trading indices compared to traditional indices and currency pairs.

Advantages of Trading Synthetic Indices

1. High leverage and tight spread allow you to maximize market exposure and profit while smartly managing your potential losses.

2. You get great flexibility when trading synthetic indices. You can choose different synthetic markets, with high or low-risk characteristics, based on your risk appetite.

3. Low capital: You don’t need a large capital to start trading synthetic indices.

4. You can trade these indices on Deriv 24/7.

5. You are aware of the potential risks right from the beginning. This means no unexpected margin calls or bad surprises.

6. They are also free of liquidity risks and real-world markets.

7. Robust cryptography and auditing measures ensure that they cannot be fixed or manipulated.

8. Fast order execution and deep liquidity always make synthetic trading indices viable for small and large traders.

9. You can also be assured of gaining exposure to new and exciting synthetic indices, given that we at Deriv heavily invest in research and development.

Synthetic Indices FAQs

Q. What is the best time to trade synthetic indices?

Synthetic indices have consistent volatility and you can easily trade at any time you see your setup and confirmation.

Q. Can you trade synthetic/Volatility indices on MT4?

No, you cannot trade synthetic indices including volatility indices on mt4. Deriv only connects to MT5 (an advanced version of MT4) which they call DMT5.

Q. How many synthetic indices brokers are there?

Deriv or formerly Binary.com is the only broker that has synthetic indices trading. It’s also the only broker that has volatility indices trading.

Final Advice on Trading Synthetic Indices

Synthetic indices offer a different trading experience that you can take advantage of. With as low as $10, you can start trading and build your portfolio to whatever amount you want.

Our recommendation is that you do lots of back-testing and find your edge.

Click here to get started.

Check FREE Trading Materials here and get unlimited Free Materials for; Forex | Synthetic indices | Stocks & indices | Commodities

Recent Comments